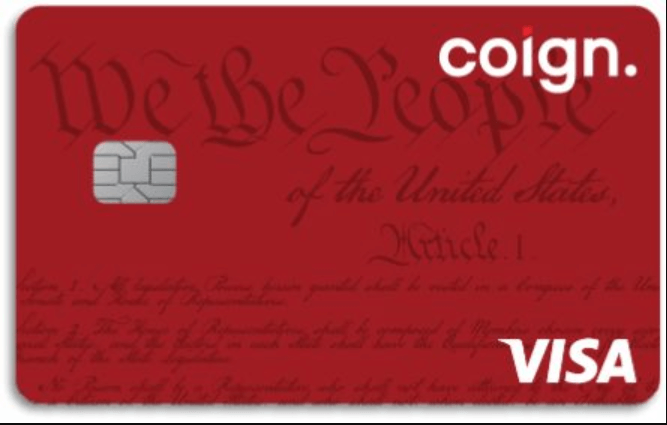

Coign Credit Card: Your Ultimate Financial Companion

In today’s fast-paced world, financial transactions and management are increasingly going digital. One such financial tool making waves in the market is the Credit Card. This article will delve into what Coign Credit Card is all about and why it might be your ultimate financial companion.

What Is Coign Credit Card?

A Modern Financial Solution

Coign Credit Card is not just another piece of plastic in your wallet. It is a modern financial solution designed to streamline your spending, offer benefits, and make your financial life more convenient.

Benefits of Coign Credit Card

1. Cashback Rewards

Coign Card offers attractive cashback rewards on various purchases, from groceries to travel expenses. These rewards can save you a significant amount of money over time.

2. Low-Interest Rates

One of the primary concerns when choosing a credit card is the interest rate. Coign Card offers competitive low-interest rates, making it a cost-effective choice.

3. Security Features

Coign Card prioritizes your financial security. With advanced security features, your transactions are protected against unauthorized access, giving you peace of mind.

How to Apply for Coign Credit Card

1. Online Application

Applying for a Credit Card is a breeze. Approval process is fast and straightforward.

2. Document Verification

After applying online, you’ll need to undergo a document verification process. This ensures that your application is complete and accurate.

3. Approval and Issuance

Once your application is approved, your Coign Card will be issued promptly, and you’ll be on your way to enjoying its benefits.

Using Credit Card Wisely

1. Paying on Time

To maximize the benefits of your Credit Card, it’s essential to pay your bills on time to avoid interest charges.

2. Managing Credit Limit

Stay within your credit limit to maintain a good credit score and financial health.

FAQs

1. Is Coign Credit Card accepted worldwide?

Yes, Coign Credit is widely accepted, making it convenient for international travelers.

2. How do I check my cashback rewards?

You can easily check your cashback rewards through the Credit Card app or website.

3. Can I increase my credit limit?

Yes, you can apply to increase your credit limit based on your financial status.

4. Are there any annual fees?

Coign Card offers some options with no annual fees, but it’s best to check the specific card details.

5. What should I do if I lose my Credit Card?

In case of a lost or stolen card, immediately contact the Credit Card customer service to report it and prevent unauthorized use. Read more…

Conclusion

In conclusion, the Coign Credit Card is a powerful financial tool that offers cashback rewards, low-interest rates, and robust security features. Applying for and using the card wisely can help you enhance your financial life. It’s time to embrace modern financial solutions and make your financial management more efficient with Credit Card.